Solid state drives, also known as SSDs, have become increasingly popular in recent years as prices have fallen and capacities have increased. However, some reports indicate that SSD prices may be starting to rise again. In this article, we’ll examine the evidence to determine if SSD prices are truly increasing in 2023.

What are SSDs?

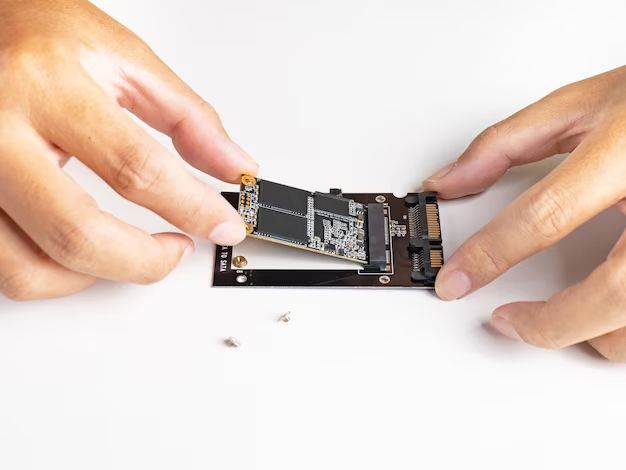

SSDs, or solid state drives, are a type of computer storage device that uses flash memory rather than traditional spinning hard disk platters. This allows SSDs to be much faster, smaller, and often more reliable than traditional hard disk drives (HDDs).

Some key advantages of SSDs include:

- Faster read/write speeds – SSDs can access data almost instantly, while HDDs require time for the platters to spin and the read head to move into position.

- Lower latency – The delay before reading/writing data is near instant on an SSD.

- Better reliability – SSDs have no moving parts, making them less prone to failure from shock or vibration.

- Smaller size – 2.5″ SSDs are much smaller than 3.5″ HDDs, making them ideal for laptops and compact PCs.

- Lower power consumption – SSDs use less energy than spinning hard drives.

For these reasons, SSDs have become the default storage choice for many consumer and business PCs, especially laptops. The key downside of SSDs is their higher cost per gigabyte compared to HDDs. However, this gap has narrowed over time.

SSD pricing trends

The price of SSDs has declined dramatically over the past decade. In 2012, consumer-grade SSDs over 500GB cost around $1 per gigabyte. By 2015, prices had fallen to around $0.30 per gigabyte. By 2019, SSD prices reached as low as $0.10 per gigabyte.

This steep decline was driven by several factors:

- Increased production of NAND flash memory – The core component of SSDs.

- Transition to 3D NAND technology – Allowed greater densities at lower costs.

- Improved manufacturing processes – Drove down production costs.

- Strong competition – Commoditization of SSDs as adoption increased.

However, SSD pricing is cyclical. Periodically, undersupply causes prices to rise temporarily before more production capacity comes online. In 2022, SSD prices rose for several months before resuming their decline.

Evidence of rising prices in 2023

In early 2023, some signs are emerging that SSD prices may be increasing again:

- Reports from DRAMeXchange indicate NAND flash prices increased 5-10% in Q1 2023.

- TrendForce analysts cite reductions in supplier inventory levels.

- Several SSD manufacturers have reported rising contract prices for client and enterprise SSDs.

- Scarcity of some SSD components like power management ICs.

- Strong demand from data centers upgrading to higher capacity enterprise SSDs.

These factors appear to have constrained supply, allowing suppliers to hike SSD prices. However, the extent, causes, and longevity of the price increases are still unclear.

Higher NAND flash prices

NAND flash memory accounts for around 35% of SSD costs. As the core component, its pricing strongly influences finished SSD costs. In Q1 2023, both DRAMeXchange and TrendForce reported a 5-10% quarterly increase in NAND flash pricing. This reverses the long-term decline in prices.

NAND flash vendors such as Samsung, SK Hynix, and Micron have slowed their pace of transitioning to newer generations of 3D NAND. This reduced the supply of higher density flash memory. Meanwhile, demand from smartphone makers stocking components ahead of new phone launches soaked up inventory.

These tight supply conditions allowed NAND flash vendors to increase prices in early 2023. If NAND prices remain high, SSD manufacturers will likely have to pass these costs onto consumers.

Lower supplier inventory

In addition to pricier NAND flash, TrendForce reports SSD and component suppliers have actively reduced inventory levels since mid-2022. High inventory was weighing on profits, prompting suppliers like Samsung to cut back.

Lower supplier inventory levels reduce buffer stocks available to meet new SSD orders. This inventory tightness can enable price hikes, as buyers lack alternatives. However, the extent to which inventories have actually been reduced is unclear outside these suppliers.

Increasing SSD contract pricing

Several SSD manufacturers have openly acknowledged price increases for SSDs in 2023. For example:

- Western Digital reported higher SSD contract pricing in Q1 2023 earnings.

- Seagate also reported rising average selling prices for SSDs.

- Micron indicated client and data center SSD pricing improved in early 2023.

These comments indicate SSD vendors feel able to charge more in 2023, likely due to supply constraints. The firms did not provide details on the scale of these increases.

Component shortages

SSD production requires components like NAND flash, DRAM chips, and power management ICs. Recent reports indicate supplies of certain components are tight.

In particular, power management ICs are in short supply. These components regulate voltage to ensure stable SSD operation. Their scarcity can constrain the supply of finished SSDs. Component vendors are struggling to add capacity due to shortages of photoresists and substrates.

Strong enterprise SSD demand

Enterprise and data center spending on high capacity SSDs for servers is forecasted to increase strongly in 2023. For example, Western Digital expects over 50% growth in enterprise SSD exabyte shipments in 2023.

This rising demand comes as suppliers have slowed transitions to higher density SSDs for enterprise markets. The strong demand and limited supply makes price increases for high capacity enterprise SSDs very likely.

Factors that could limit price increases

However, there are also reasons why the extent of SSD price increases may be limited in 2023:

- Ongoing transitions to newer 3D NAND nodes and higher layer counts will eventually boost supply.

- High prices may soften consumer demand, balancing the market.

- Investment in additional NAND flash fabs could increase supply medium-term.

- Strong competition between SSD vendors may curb price hikes.

Transitions to higher density 3D NAND

SSD manufacturers are in the process of transitioning to newer generations of 3D NAND technology. These include:

- 192 layer 3D NAND from 176 layer.

- 232 layer 3D NAND from 192 layer.

Increasing 3D NAND layer counts boosts densities and reduces costs. This greater supply should alleviate pricing pressure. However, the transitions have been slower than expected. Once ramped up, these shifts will increase supply.

Softening consumer demand

If SSD prices rise too much, it may curb demand from price-sensitive consumers. PC and laptop sales could slow if end-users defer purchases due to high SSD costs. Data center spending could also be impacted if enterprise SSD prices rise drastically.

This softening demand would help rebalance supply, limiting the scale and duration of any SSD price increases. However, enthusiast consumers may continue buying regardless of inflated prices.

Investment in new NAND fabs

The major NAND flash vendors are all investing in new fabrication facilities to increase production capacity. For example:

- SK Hynix plans to spend $106 billion building four new fabs in South Korea.

- Micron will invest $15 billion in a new fab in the US.

- Western Digital and Kioxia are investing $20 billion in a new Japanese fab.

These investments will take years to impact supply. But eventually the new fabs could alleviate pricing pressure depending on demand growth.

Competitive SSD market

There is strong competition between SSD manufacturers and no shortage of alternatives for consumers. Major vendors include Samsung, Western Digital, Seagate, Micron, SK Hynix, and Kioxia.

If one vendor inflates prices excessively, consumers can readily switch to alternatives. This competition will likely curb extreme SSD price hikes, though it cannot prevent more moderate increases.

SSD pricing outlook for 2023

Taking these factors into account, the outlook for SSD pricing in 2023 is mixed. Here are some potential scenarios:

- Moderate price increases – Limited NAND supply and strong data center demand causes somewhat higher SSD prices through 2023. But competition prevents extreme hikes.

- Brief spike, then decline – SSD prices rise in early 2023 due to temporary undersupply, before additional NAND capacity causes prices to resume their downward trend.

- Prolonged shortage – NAND supply remains highly constrained through 2023. SSD prices spike further and remain elevated through the year.

The most likely scenario seems to be a moderate price increase of perhaps 10-20% for some models and capacities in 2023.

For consumers, this will mean slightly higher SSD prices after years of steady declines. But prices are unlikely to spike drastically or prevent further adoption of SSDs.

For suppliers, some price increases will be welcomed after several weak years. But restrictions on supply to artificially inflate prices could easily backfire medium-term.

Forecasted price changes by SSD segment

Here are the projected price changes in 2023 for key SSD segments:

| SSD Segment | Expected 2023 Price Change |

|---|---|

| Consumer/client SSDs | 5-15% increase |

| High capacity enterprise SSDs | 10-20% increase |

| External portable SSDs | 0-5% increase |

Enterprise and high capacity SSDs look most at risk of price hikes due to ramping data center demand. Mainstream consumer SSDs will likely see more moderate increases.

Conclusion

After almost a decade of price declines, SSD pricing now appears to be increasing moderately in 2023.

Key factors driving prices higher include:

- Reduced NAND flash supply as vendors slow transitions.

- Inventory reductions by suppliers.

- Strong data center demand for enterprise SSDs.

- Component shortages like power management ICs.

However, competition and eventual supply increases will likely prevent extreme or prolonged SSD price spikes.

Consumers can expect to pay slightly more for SSD storage in 2023. But the long-term trajectory remains downward as new NAND fabs come online. Careful supply management will be needed to balance growing SSD demand with prices that maximize supplier profits.