In Louisiana, the statute of limitations on debt collection is 3 years. This means a debt collector has 3 years from the date of your last payment or last activity on the account to sue you for the debt.

What is the statute of limitations on debt in Louisiana?

The statute of limitations for debt in Louisiana is 3 years. This applies to written contracts, open accounts, and promissory notes. Some key points about the statute of limitations:

- The clock starts on the date of your last payment or last activity on the account.

- If you make a payment after the limitation period expires, it restarts the clock.

- The statute of limitations is a defense if you get sued. You must assert it or you waive it.

- Louisiana uses a “one action” rule, meaning one lawsuit to collect the debt.

What types of debt have a 3 year statute of limitations in Louisiana?

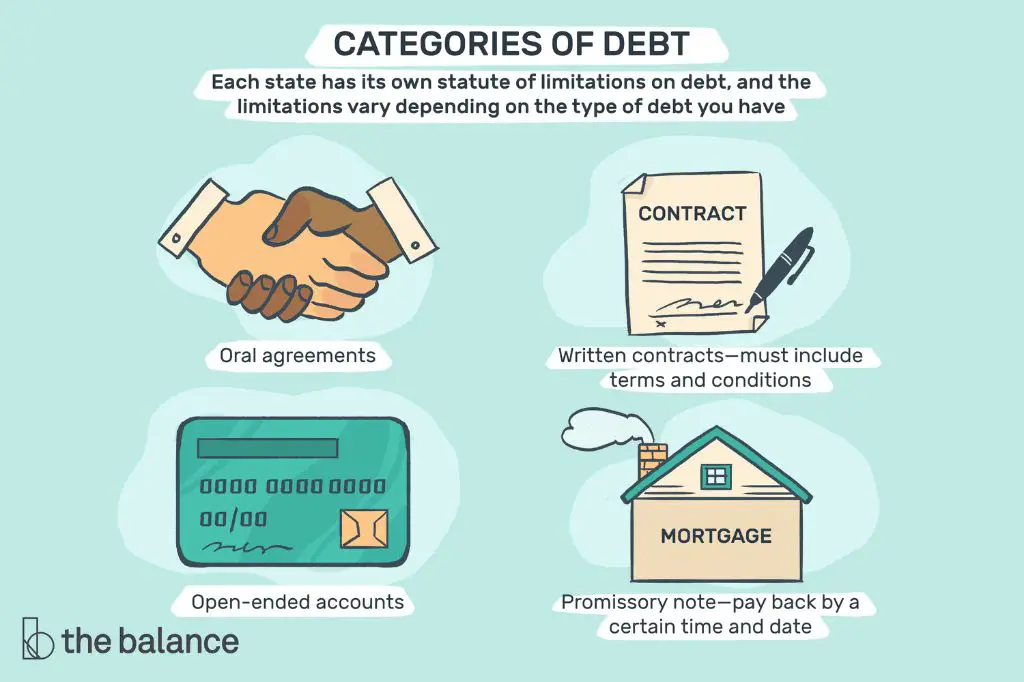

In Louisiana, the 3 year statute of limitations applies to the following types of consumer debt:

- Open accounts – These are flexible credit accounts like credit cards, store charge cards, and personal lines of credit.

- Written contracts – This includes promissory notes, IOUs, or other written agreements to repay a debt.

- Oral contracts – If not otherwise specified, oral agreements have a 3 year limitation.

- Service fees – Fees for services from professionals like attorneys, accountants, physicians.

- Overdraft fees – Fees banks charge for overdrawing your account.

- Money judgments – If a court awards a judgment for the plaintiff, it must be enforced within 3 years.

What debt is excluded from the 3 year statute of limitations?

Some types of debt are excluded from Louisiana’s 3 year statute of limitations, including:

- Federal student loans – Statute does not apply to federal student loans.

- Child support – No statute of limitations on collecting child support.

- Taxes – No statute of limitations on collecting owed taxes.

- Mortgages – Action must be taken within 6 years for mortgages.

- Government fines – No statute of limitations on fines owed to the government.

For these excluded debts, the debt collector can pursue payment indefinitely. There is no time limit to sue or collect on the amounts owed.

What restarts the debt collection statute of limitations in Louisiana?

The statute of limitations clock resets to zero if you do any of the following:

- Make a payment – Any payment restarts the 3 year clock.

- Make a written promise to pay – Signing a repayment agreement restarts the clock.

- Make a verbal promise to pay – In Louisiana, even verbally promising to pay restarts the statute.

- Make a written acknowledgement of the debt – Writing a letter that acknowledges the debt will reset the clock.

- Agree to a settlement offer – Accepting a settlement resets the statute of limitations.

As long as you do not take any of these actions, the debt will continue to age beyond the statute. The creditor will be prohibited from suing if the statute expires.

What happens when the statute of limitations expires in Louisiana?

If the 3-year statute of limitations passes in Louisiana, several things happen:

- The creditor cannot sue to collect the debt.

- The creditor can still attempt to collect through letters and calls.

- The debt still exists, but the creditor loses the ability to sue.

- The debt remains on your credit report for 7 years.

- Making a payment restarts the statute of limitations clock.

While the creditor can no longer sue, they may still attempt to get you to make a payment by contacting you. The debt also remains on your credit report for 7 years from the date of first delinquency.

Can a debt collector still contact me after the statute expires?

Yes, a debt collector can still contact you about an expired debt in Louisiana. Since the debt still exists and is still owed, the collector is not prohibited from attempting to collect through letters, calls, or other methods. However, they lose the ability to sue to recover the amounts owed.

Under the FDCPA, debt collectors cannot imply that they have the ability to sue if the statute of limitations has in fact expired. But they can continue to ask you to pay voluntarily.

Should I pay a debt that’s past the statute of limitations?

If a debt collector contacts you in Louisiana about a stale debt, you are not legally obligated to pay. The creditor lost the ability to sue once the 3-year statute expired. However, you have a few options:

- Pay nothing – You can ignore requests to repay since they can’t sue. But they can keep contacting you.

- Pay a reduced settlement – Offer to pay a smaller portion to resolve the debt.

- Pay in full – You can choose to repay the entire balance, even if not legally required.

Paying anything restarts the statute of limitations clock. A paid collection also remains on your credit report for 7 years from the payment date. Consult a Louisiana debt attorney before making payments on expired debts.

How long do unpaid debts stay on your credit report in Louisiana?

In Louisiana, negative information stays on your credit report for 7 years from the date of first delinquency. Some key points on how long unpaid debts remain on your credit reports:

- Most debts fall off your credit report after 7 years, even if still unpaid.

- Chapter 7 and 13 bankruptcies stay for 10 years from filing date.

- Unpaid tax liens expire after 15 years.

- Unpaid civil judgments expire after 10 years.

- There are no state laws requiring earlier removal of unpaid debts.

Debt collectors may still attempt to collect an unpaid debt after it ages off your report. There is no time limit on how long they can attempt to pursue collection. Having expired debts removed from your credit report can help improve your credit score.

Will the debt collector remove the debt from my credit report?

Debt collectors are not required to remove expired debts from your credit report in Louisiana. Since the unpaid debt still exists and is still legally owed, they typically choose not to request deletion from your credit history.

Some options for attempting removal of expired debts include:

- Contact the collector in writing to request deletion.

- Contact the credit bureaus to dispute the expired item.

- Hire a credit repair company to assist in requesting removals.

- Wait for the negative item to expire after 7 years.

Keep in mind unpaid collections will still appear for 7 years despite expiring under the statute. Paying or resetting the statute will restart the credit reporting period.

Can I negotiate a settlement on an expired debt in Louisiana?

You can attempt to negotiate a settlement on an expired debt with a debt collector in Louisiana. Since they lose leverage to sue, collectors may be more likely to approve reduced payment offers.

Some tips for negotiating debt settlements on time-barred debts:

- Research your state laws and verify the debt falls outside the statute.

- Start with a low offer, often 20-30% of the balance.

- Get any settlement offer agreement in writing before paying.

- Ensure the written agreement states payment as “payment in full.”

- Ask the collector to delete the item from your credit report after paying.

- Consult a debt attorney before accepting a collection settlement.

Be aware that paying revives the debt under state law. Negotiate the removal of any settlements from your credit report after payment.

What are my rights when dealing with debt collectors in Louisiana?

You have certain rights and protections under Louisiana and federal law when interacting with debt collectors.

- Collectors cannot imply they have the ability to sue if the debt is time-barred.

- Collectors cannot harass, oppress, abuse, or threaten you.

- Collectors cannot lie or misrepresent the amount or status of your debt.

- Collectors must honor written requests to stop contacting you.

- Collectors cannot contact you before 8:00 am or after 9:00 pm.

- Collectors cannot share your debt information with employers, family, or others.

You can sue debt collectors in Louisiana for violations. Collectors also cannot take actions like threatening arrest or improper wage garnishment. Always consult with legal counsel about your debt collection rights.

What is the best way to respond to debt collectors on time-barred debts in Louisiana?

When responding to collectors about expired debts in Louisiana, follow these steps:

- Request written verification of the debt – Collectors must prove you owe the amount claimed.

- Review the verification and confirm the statute expired – Verify your records and state laws.

- Send a debt validation letter disputing the validity of expired debts.

- State that you will not pay due to passing of the statute of limitations.

- Keep records of all correspondence and calls in case of violation.

- Get collector contact in writing to prevent resetting statutes.

When asserting your rights, be firm and explain you know the law prohibits lawsuits on the expired debt. Seek legal advice if the collector ignores your requests or your state law rights.

Can I get a debt collector to stop contacting me after the statute expires?

In Louisiana, you can get a debt collector to stop contacting you about an expired debt by taking these steps:

- Send a cease and desist letter demanding no further contact.

- Under the FDCPA, collectors must honor verified written cease communication requests.

- Follow up with phone calls reiterating your request for no further contact.

- File complaints with the state attorney general and Consumer Financial Protection Bureau if violations occur.

- Consult an attorney about additional stop contact options and potential lawsuits for harassment.

Keep thorough records of your requests. If the collector contacts you after receiving your cease and desist letter, they violate state and federal law. You can then take legal action to recover damages.

What legal options are available if a debt collector sues over an expired debt?

If a debt collector files a lawsuit to collect a time-barred debt in Louisiana, you have legal options to respond:

- File a written response – Assert the expiration of the statute of limitations as an affirmative defense.

- Challenge court jurisdiction – File a motion to dismiss due to exceeding the statute.

- Attempt negotiation – See if the collector will dismiss the suit if you pay a smaller settlement.

- File counterclaims – Sue the collector for violations of consumer protection laws.

- Appear in court – Present evidence and your version of the events to the judge.

- Seek legal advice – Contact a consumer law attorney to understand your options and rights.

With proper evidence and the law on your side, you can potentially get the lawsuit dismissed. Seek help from legal aid or lawyers to assist in responding and defending against lawsuits over expired debts.

What damages can I recover if a debt collector violates the law in Louisiana?

If a debt collector illegally sues or harasses you over an expired debt in Louisiana, you may recover:

- Compensatory damages – For financial losses from any improper collection lawsuits.

- Additional damages – Up to $1,000 for individual violations of the FDCPA.

- Punitive damages – For intentional or reckless violations of your rights.

- Attorneys fees – If you hire a lawyer, the debt collector may have to pay your legal costs.

- Emotional distress damages – For stress, anxiety, embarrassment the collection agencies caused you.

- Cease contact order – To prohibit the collector from any further calls or letters.

Save all correspondence and document any statutory violations. Seeking legal counsel can help maximize your monetary compensation and stop further collection harassment.

Key takeaways on Louisiana’s laws for debt collection statutes of limitations

In summary, key facts on Louisiana’s statute of limitations on debt collection include:

- Most consumer debts expire after 3 years of no payments or activity.

- The clock restarts if you make a payment or promise to pay.

- Collectors can still contact you but cannot sue once the statute runs out.

- Unpaid debts stay on your credit report for 7 years from first delinquency.

- Get collector agreements to stop contact or remove credit reports in writing.

- Talk to a lawyer before making payments on old debts.

Understanding your rights and Louisiana’s statutes is crucial when dealing with debt collectors. Expired debts remain legally owed, but lose enforcement through the courts. Consult with legal counsel to ensure the law protects you against any collection harassment or lawsuits on old debts.